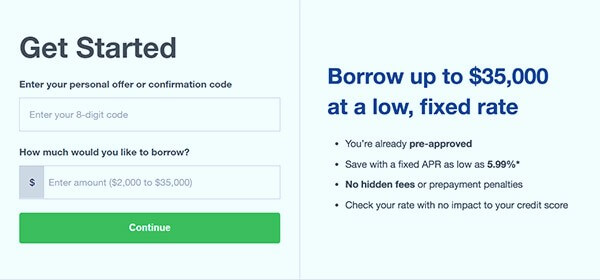

MyProsperCash combines borrowers and investors for instant online loans. Qualified individuals can borrow $ 2,000 or up to $ 40,000 for a period of three or five years. You can get a decent amount of loan amount with fewer interest rates after registering on this portal.

MyProsperCash loans have a fixed annual interest rate of only 5.99%, with no hidden fees or prepayment fees, and checking an interest rate has no impact on your credit rating. Although the maximum amount that can be financed online is $ 35,000 more. It is necessary that you register yourself on the official portal first before using the services offered here.

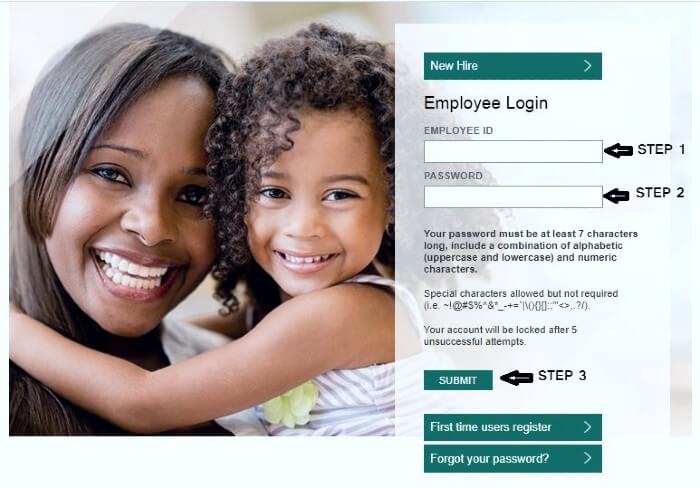

MyProsperCash Login Process

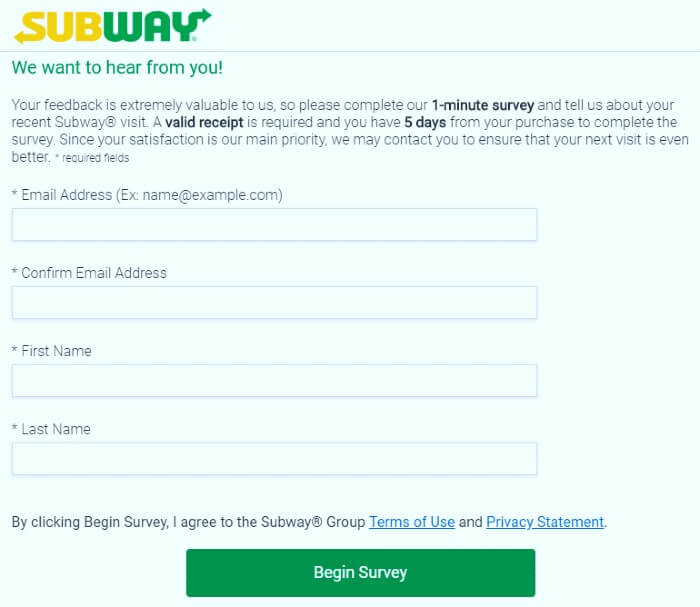

To request for a Prosper Personal Loan on the official website of MyProsperCash.com, people must meet the basic requirements and follow the procedure described below: –

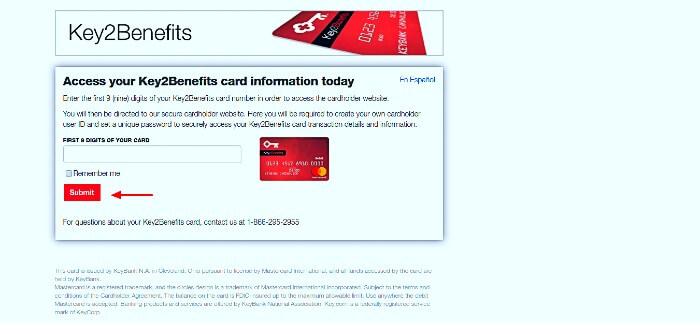

- Visit the official website of the Prosper platform at MyProsperCash.com

- Bring your receipt with the verification code.

- Input the 8-digit verification code in the appropriate section of the dashboard page.

- Now check the code submitted and hit the button that says “Next”.

- Confirm the legal terms, fixed terms, personal loans, and interest.

MyProsperCash Portal Working Flow

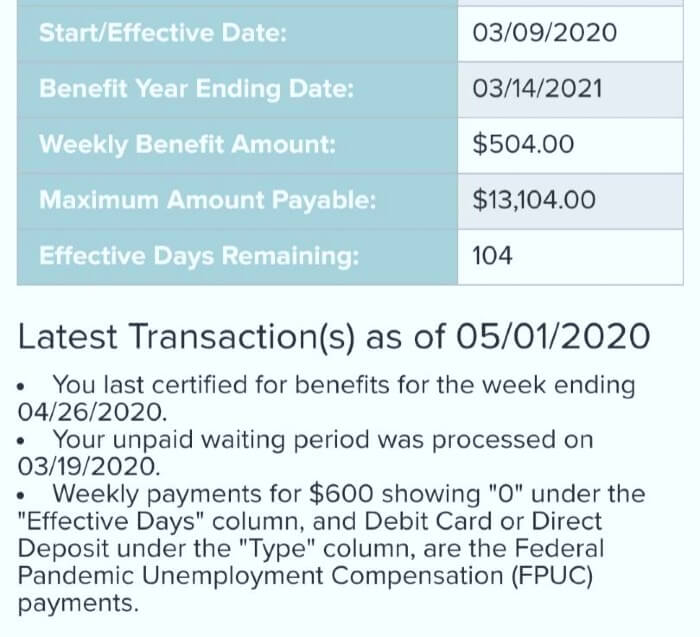

Prosper does not provide complete information on how loan applications are approved or how a loan is made. However, first-time applicants generally require a credit score of 640 or higher.

The MyProsperCash rules can be more comprehensive for borrowers who are happy to pay off their first available Prosper loans. The services of the Prosper are accessible to borrowers in most states in the United States. However, individuals should check with their local banking regulator to see if P2P lending is allowed in the jurisdiction.

MyProsperCash sets an interest rate and loan principle based on past qualifications and the desired term. The official MyProsperCash portal can be used at the website address MyProsperCash.com.

Once issued, the MyProsperCash loan will be transferred periodically by direct debit to the specified bank account. The monthly payment, which depends on the size, interest rate, and interest rates of the loan, corresponds to the term of the loan.

If it takes more than 15 days to pay off the MyProsperCash loan, you will be charged $ 15 or 5% of the unpaid deposit amount. If data subjects are delayed more than 30 days due to insufficient funds in the linked account, MyProsperCash may contact a debt collection agency.

MyProsperCash Benefits

Some of the major benefits of using the online portal are as follows:

- The loan approval process is quite simple as compared to other similar portals.

- You can get an APR of up to 5.99% after signing up on the official portal.

- There are no hidden fees or prepayment penalties.

- The credit scores can be checked without any effect on the interest rates.

Compared to these institutions, Prosper offers more flexible approval standards and shorter financing times for borrowers with official MyProsperCash. The www.myprospercash.com portal is the best portal in terms of accessing the financial details.

The primary competitors of the MyProsperCash include other P2P lenders such as Lending Club and Peerform. But, the interest rates offered on this portal are quite less as compared to other similar portals.

The Portal

MyProsperCash is a great option to make financial transactions in an extremely easy and a secure way. The interest rates on this online portal are extremely nominal when we compare it with other similar portals. The loan amount that you will be provided with depends on your credit score. The minimum credit score of 640 is a must to get the loan from this portal.

MyProsperCash offers an extremely secure way to access financial information. Therefore, it is suitable for all commercial borrowers or those seeking specialized financing or refinancing. The process is extremely transparent on this portal and thus you can trust the same by every aspect.

The primary advantages of this portal cover low minimum investment requirements, fast borrower financing, relatively high credit limits, flexible purchase prices, and easy registration process.

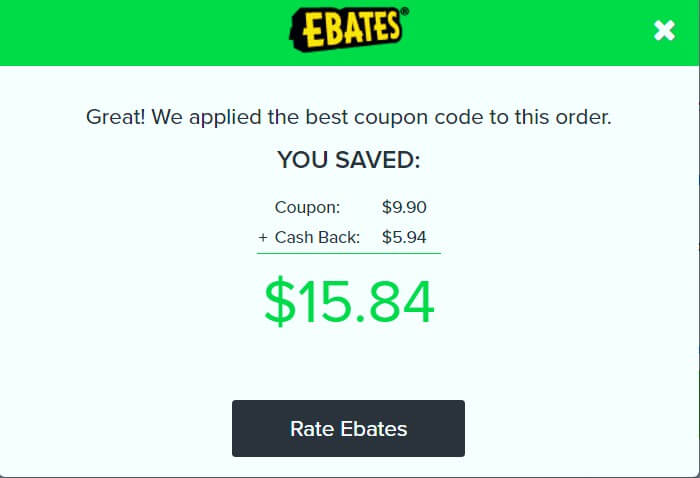

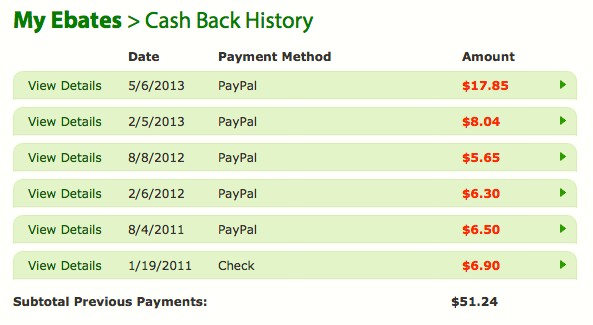

The Automatic Receipt

MyProsperCash Quick Invest tool makes it easy for employees to invest in standards-compliant loans and quickly improve their credit score. This tool, known as Quick Invest, digitally verifies loans based on desired criteria and offers a specific dollar amount each time an order is verified.

MyProsperCash Contact Information

To contact Prosper, you can use the number 1- (866) 615-6319

The customer support is available from Monday to Friday (8 AM to 9 PM) and on Saturday from 8 AM to 6 PM.

You can also send your complaint in writing at the postal address:

P.O. Box 396081

San Francisco, California 94139-6081.

MyProsperCash offers a decent amount of loans without any burden of high-interest rates. Good borrowers can get unsecured loans, but interest rates can be high if they don’t have higher credit. MyProsperCash offers secured personal loans to investment organizations between $ 2,000 and $ 40,000.

Compared to various other loan providers in the market, Prosper offers more flexible approval standards and shorter financing times for borrowers with official MyProsperCash. The online portal makes money from creation and service fees.

The MyProsperCash Login portal has done an incredible job in providing the users with a loan with extrmely fewer interest rates. Accessing the offered services are quite simple after you register on this portal. The high encryption makes it safe for you to submit your financial details on this portal.

If you have any issues while using this portal or if you need the help of the customer support, click the “Contact Us” link at the bottom of the page for more information. The phone number to reach out to the customer support is 1- (866) 615-6319 or 1- (877) 646-5922. Also, you can send your issues in the writing at the Postal Address Prosper Marketplace Inc. PO Box 396081 San Francisco, CA 94139-6081.

Start your new loan by registering at www.myprospercash.com. Prosper is one of the most popular companies that connect people who desire to borrow money from investors from the market. Borrowers can apply for a loan to see if they are eligible for an offer or not.