PHH Mortgage is one of the leading five mortgage lenders in the United States. The Mortgage Association, headquartered in Mount Laurel, NJ, guides and assists families with home loans. The organization also offers other services, that include shipping credits, trademark inquiries, services, and service promotion. The Mortgagequestions portal has been of great help for users all over the country.

If you are looking for an economical way to repay your mortgage, using the official www.mortgagequestions.com may be of interest to individuals. They offer a wide range of ways to pay off your mortgage quickly. This portal is an online service that assists homeowners and buyers to find the right type of funding for their profession.

| Portal Name | Mortgagequestions |

|---|---|

| Portal Type | Login |

| Mode Of Use | Online |

| Sector | Financial |

| Site | Official Site |

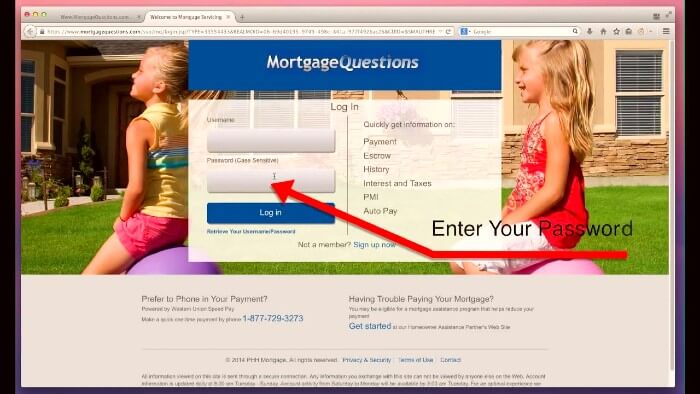

Mortgagequestions Access Steps

Here are some of the simple steps people can take to access the Mortgagequestions Login portal. We ensure that you won’t face any sort of issues in accessing this portal after going through these steps.

- First, account holders should visit the official website at www.mortgagequestions.com.

- Then sign into the account by using the correct username and password.

- Finally, click on the login button to access your Mortgagequestions user account.

- Account-holders can not only pay their bills but also access their account information and other user details.

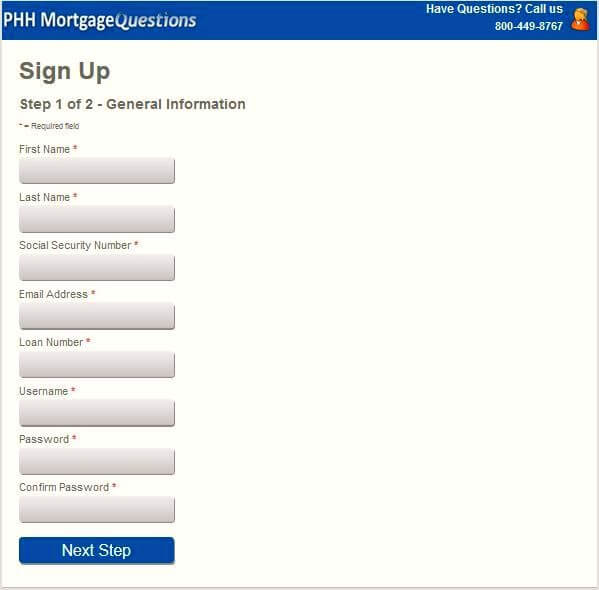

If users wish to sign up on the official mortgage website, they must first register on the same website and follow the instructions listed below:

- Visit the official website at the address Mortgagequestions.com

- It is a secure website for multiple payments.

- This portal can be best used by using the Mozilla Firefox browser.

- Visit the page to create a new account and enter the classified details, such as first and last name, correct email address, and contact number in the online portal.

- Then add the bank’s characteristics and other Mortgagequestions details.

- People are being sued for their email address, cell phone number, and loan amount. After listing the details, the button below is assigned.

- Then the person must complete the sign-up process.

- Now, a mail along with the account activation link will be dispatched to your email address. You need to click this link to verify your email address.

- Make sure that you fill the form with the inquired information. Individuals will receive their login details via the email address provided during registration.

Mortgagequestions Account Assistance

Here are some simple steps that account holders can follow to request a Mortgagequestions username and password. This is your first visit to the PHH Mortgagequestions home page.

- People have the opportunity to study one of the following options, such as Obtain username, password, and security questions in the Username and Password section.

- Enter your name and email address in the space provided.

- Finally, click the Submit section to get the credentials to the email address associated with the PHH Mortgagequestions login account.

Mortgagequestions Customer Support

People can email mortgage questions for help. By clicking on the Contact Us section on the website, users will be getting another email where they can submit their contact details and PHH loan number. In this way, users get specific support based on their account.

PHH Mortgage customers can also contact PHH Mortgage Questions during business hours at 1-800-449-8767. The customer support team is available from Monday to Friday. You can talk to them from 9 AM to 9 PM.

Mount Laurel, NJ-based services incorporate credit services, brand credit, and advertising services. This portal offers a fraction of loans that range from FHS to VA and conventional loans. People looking to refinance or buy a new home can use a wide range of services to help them find the right home for them.

Customers can pay the mortgage not only by phone and online but also by mail. Account-holders can submit a limit to the PHH Postal Service to eliminate the mortgage. Kindly note that the credit number is stamped on the reverse side of the cheque so that the PHH team can process the payment successfully.

Home Loan Payments – Customer Service

Mailbox 5452

Mount Laurel, NJ 08054-5452

Interest Rates

High-interest rates result in higher monthly payments and add to the total interest you pay over the life of the loan. A low-interest rate saves money in the short and long term.

Of course, it is almost unmanageable to plan your home purchase with the best interest rates in a way that you cannot plan. According to the Federal Mortgage Loan, Mortgage Loan Corporation has maintained some of the cheapest interest rates in history for the past five years, and its latest projections suggest that the trend will continue into 2018. The Mortgagequestions portal has been launched by them that gives you a clear idea about the interest rates.

It can be tricky to plan to buy your home with the best interest rates, but there are things you can do to get a lower interest rate. For example, one of the advantages of a 15-year fixed-rate mortgage is that it has a lower interest rate than a 30-year fixed-rate mortgage. Sometimes a higher down payment can also assist the users to get a commending interest rate.

The Mortgagequestions Points

Mortgage points, or discount points, are a way to prepay interest to get a lower interest rate on the mortgage.

Each mortgage point is equal to 1% of the value of your home. In other words, if you borrow $ 250,000 and have two repayment points, you pay $ 5,000. In most cases, one point can lower your interest rate from one eighth to one-fourth percent.

Mortgagequestions.com is a web portal for favorable loan and mortgage payments. If you have any questions about your home loan/mortgage, your security deposit, your payment history, your interest rate and taxes, your SEP or automatic loan and mortgage methods, and ways, your questions will be answered on the official website at Mortgagequestions.com portal.

When applying for a mortgage without a credit score, you must go through a process termed as manual underwriting. Manual signing simply means that you will be required to provide the subscriber with some extra documents for personal review. The loan process may take a little longer, but it is worth buying a home without acquiring additional debt!